Automated prequalification V3

Automated

Pre-qualification

Run pre-qualifications through a dynamic and data-driven flow that turns any input into a complete picture, evaluates it in real time, supports collaboration, and keeps everything compliant.

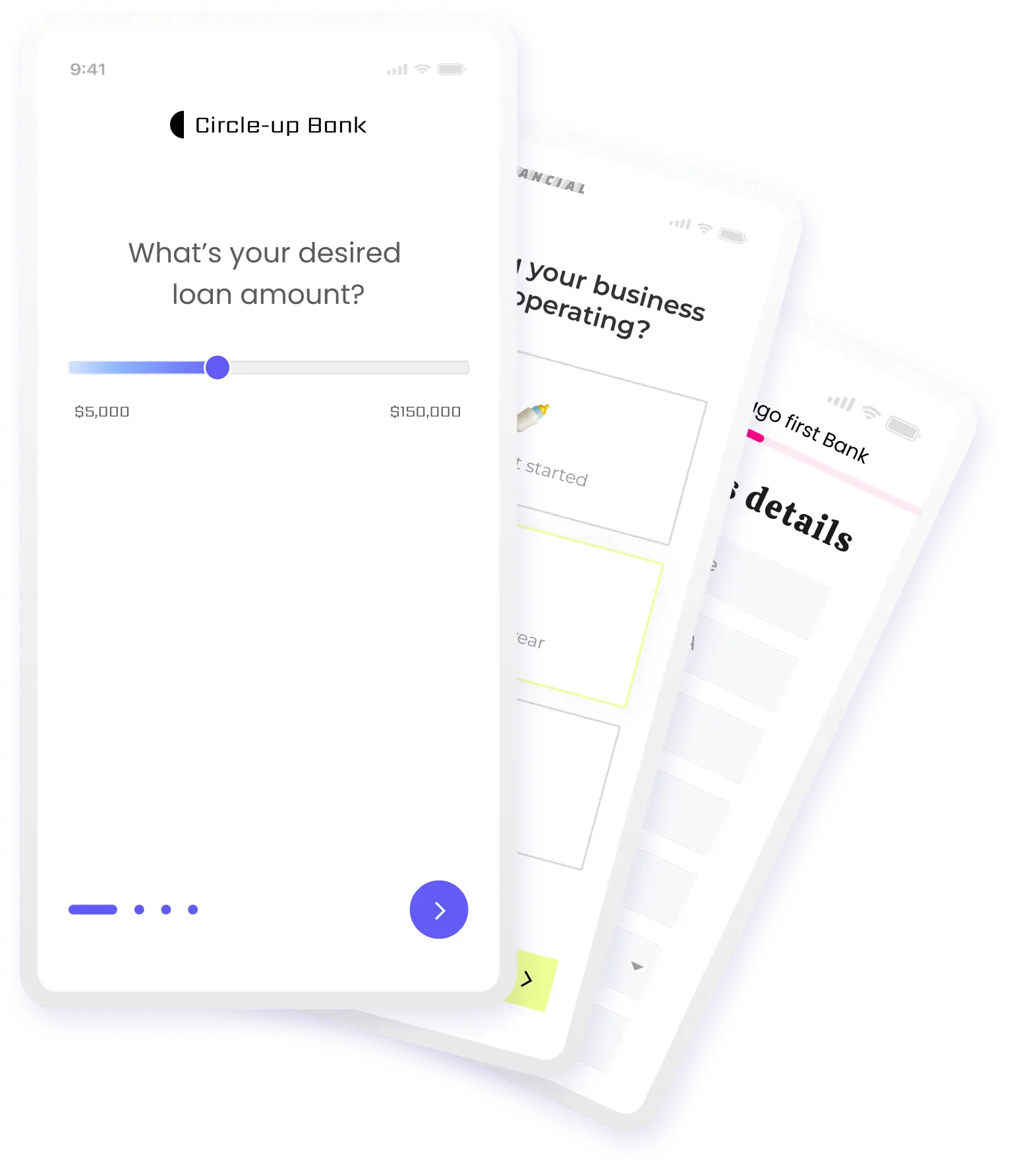

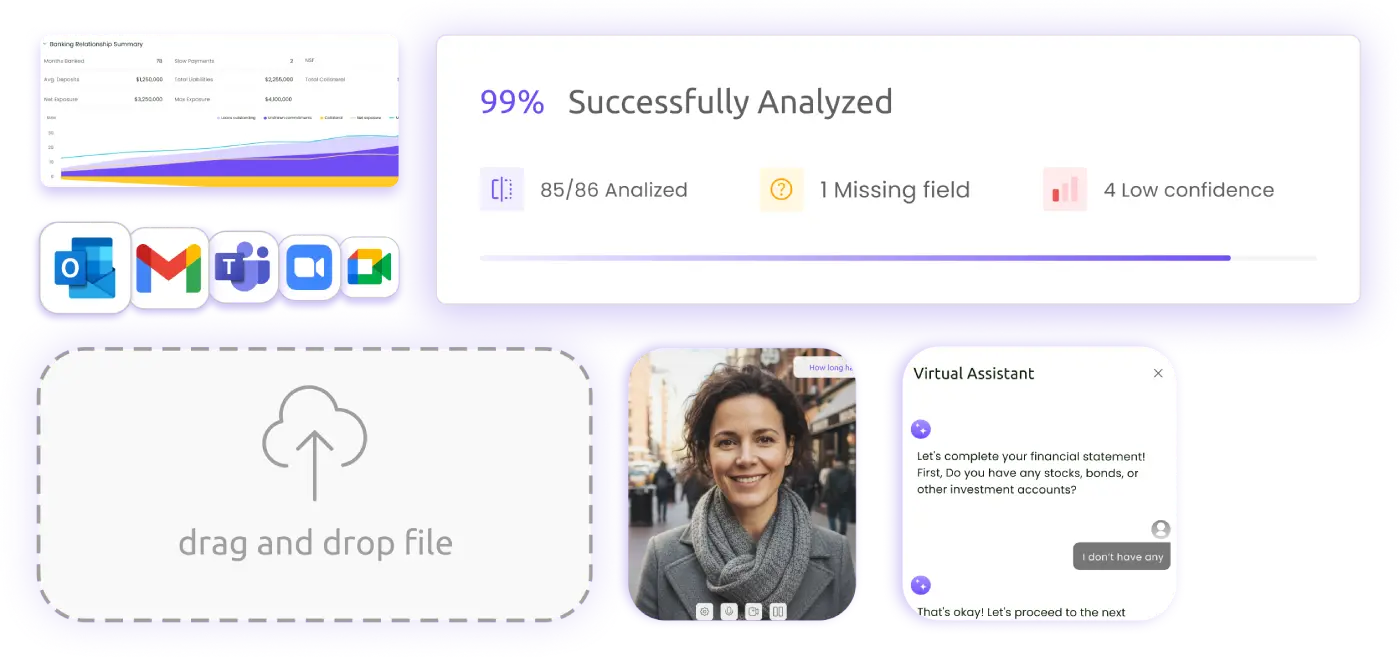

Drop anything in. AI Agents will do the rest.

Drop in a folder full of documents, an email thread, a Teams call, or connect applicants to a digital portal. Lama AI turns every input into a structured and dynamic application in seconds, so your prequalification flow works wherever, and however, the deal starts.

Drop anything in. AI Agents will do the rest.

Drop in a folder full of documents, an email thread, a Teams call, or connect applicants to a digital portal. Lama AI turns every input into a structured and dynamic application in seconds, so your prequalification flow works wherever, and however, the deal starts.

All the data you need, already pre-filled.

AI pulls customer information from your systems, ingests documents and records, and connects to financial, credit, industry, and tax data sources in real time. Skip the questions you could already have the answer for, and ask customers to share only what is still missing, if anything at all.

All the data you need, already pre-filled.

AI pulls customer information from your systems, ingests documents and records, and connects to financial, credit, industry, and tax data sources in real time. Skip the questions you could already have the answer for, and ask customers to share only what is still missing, if anything at all.

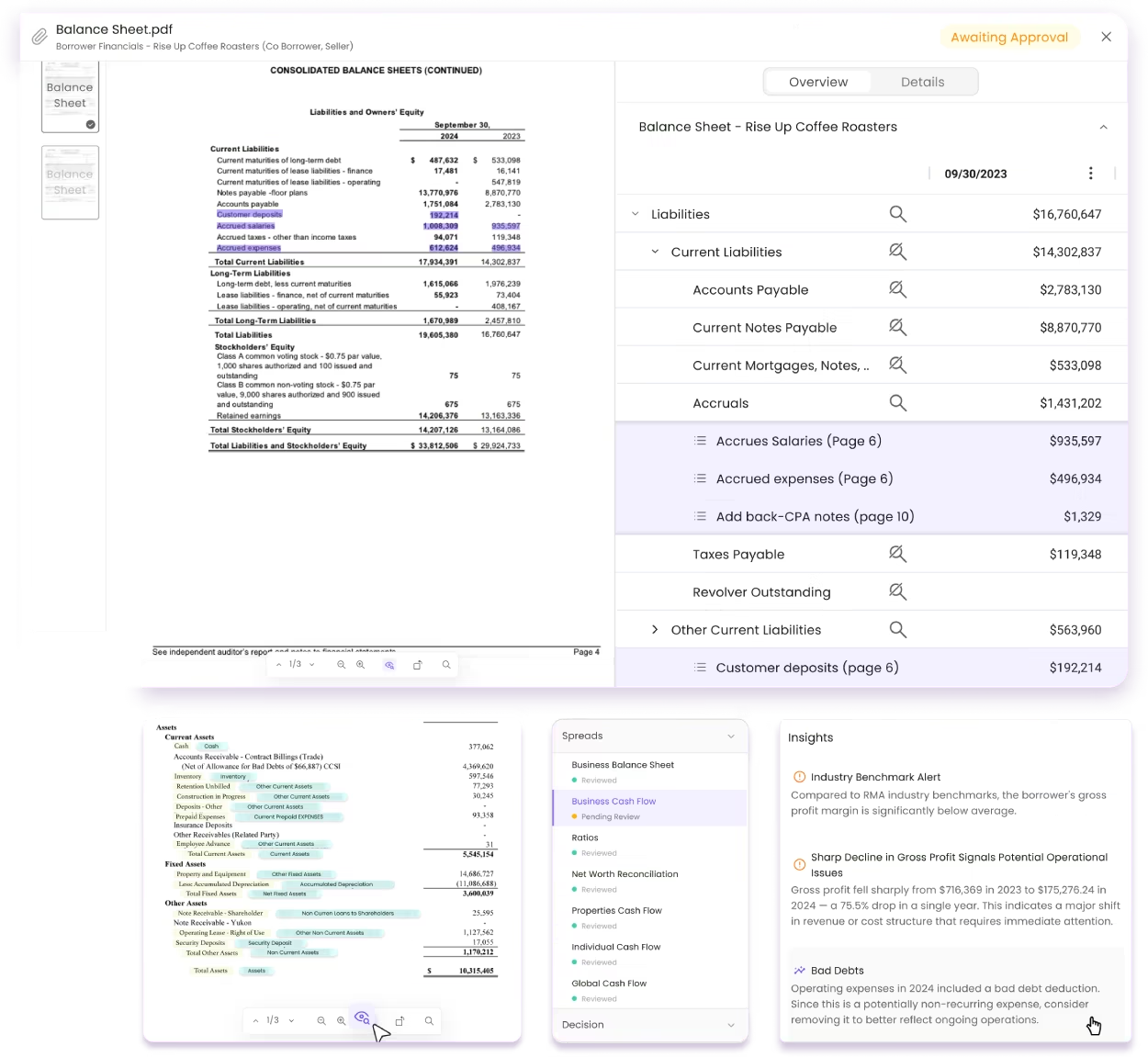

Documents go in.

Financials come out.

Whether its tax returns, financial statements, or rent rolls - we got your back. Lama AI’s models automatically extract the values, organizes them, and turns them into ratios and insights you can evaluate (or automate), in seconds.

Documents go in.

Financials come out.

Whether its tax returns, financial statements, or rent rolls - we got your back. Lama AI’s models automatically extract the values, organizes them, and turns them into ratios and insights you can evaluate (or automate), in seconds.

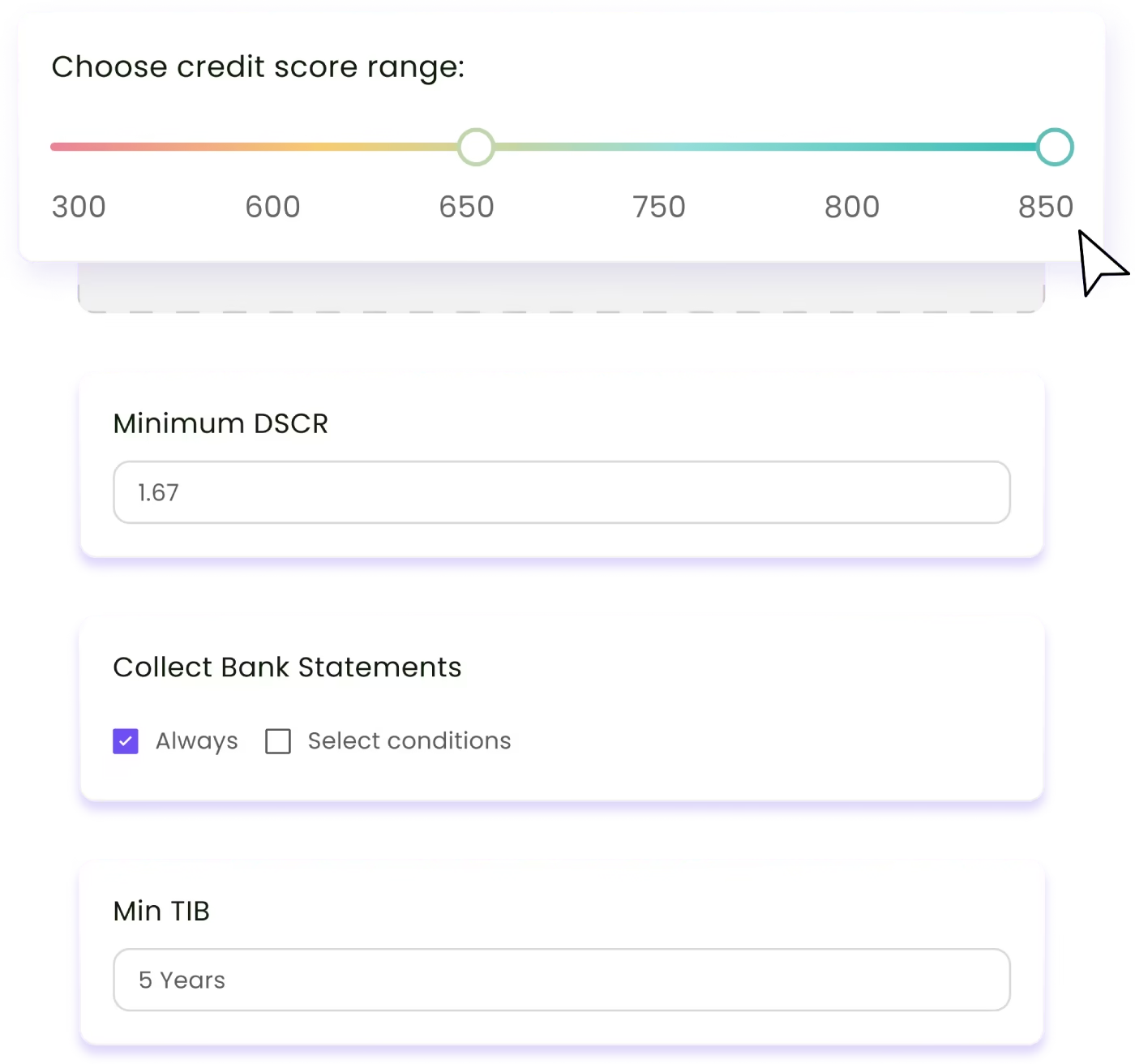

Real time policy engine

Lama AI turns your credit rules into an active engine that evaluates each deal automatically as data is gathered. Advance the deals that fit, offer better options where they don’t, and cut the time spent on files that have no path forward.

Real time policy engine

Lama AI turns your credit rules into an active engine that evaluates each deal automatically as data is gathered. Advance the deals that fit, offer better options where they don’t, and cut the time spent on files that have no path forward.

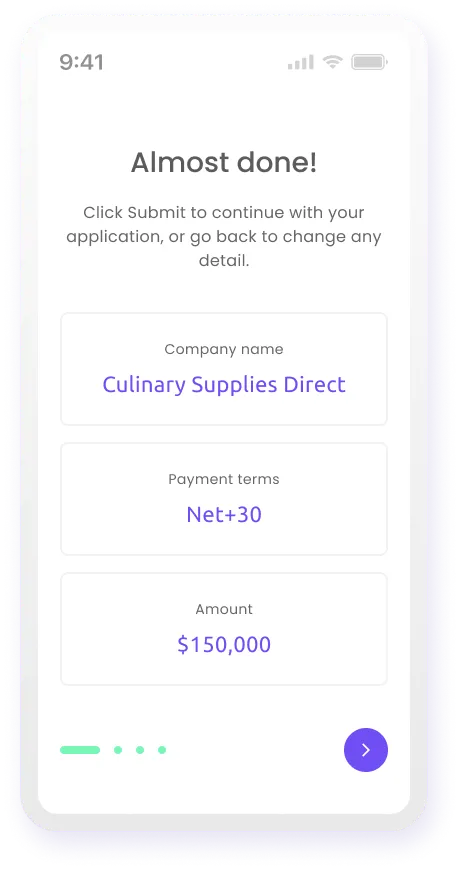

Any origination source. One application flow

Bankers and borrowers collaborate as they go, and owners, employees, CPAs, brokers, and other stakeholders can complete their part from any channel, no matter how the application started. With an advanced permissions engine, you can ensure each person sees only what they should, keeping the process secure and straightforward.

Any origination source. One application flow

Bankers and borrowers collaborate as they go, and owners, employees, CPAs, brokers, and other stakeholders can complete their part from any channel, no matter how the application started. With an advanced permissions engine, you can ensure each person sees only what they should, keeping the process secure and straightforward.

Compliance handled automatically

Meet fair lending requirements with timely decline notices and a process that effortlessly aligns with Reg B, from when decisions are made to how they are communicated. Audit trails keep everything easy to review, and access controls protect the flow from end to end so your team stays fast and consistent.

Compliance handled automatically

Meet fair lending requirements with timely decline notices and a process that effortlessly aligns with Reg B, from when decisions are made to how they are communicated. Audit trails keep everything easy to review, and access controls protect the flow from end to end so your team stays fast and consistent.

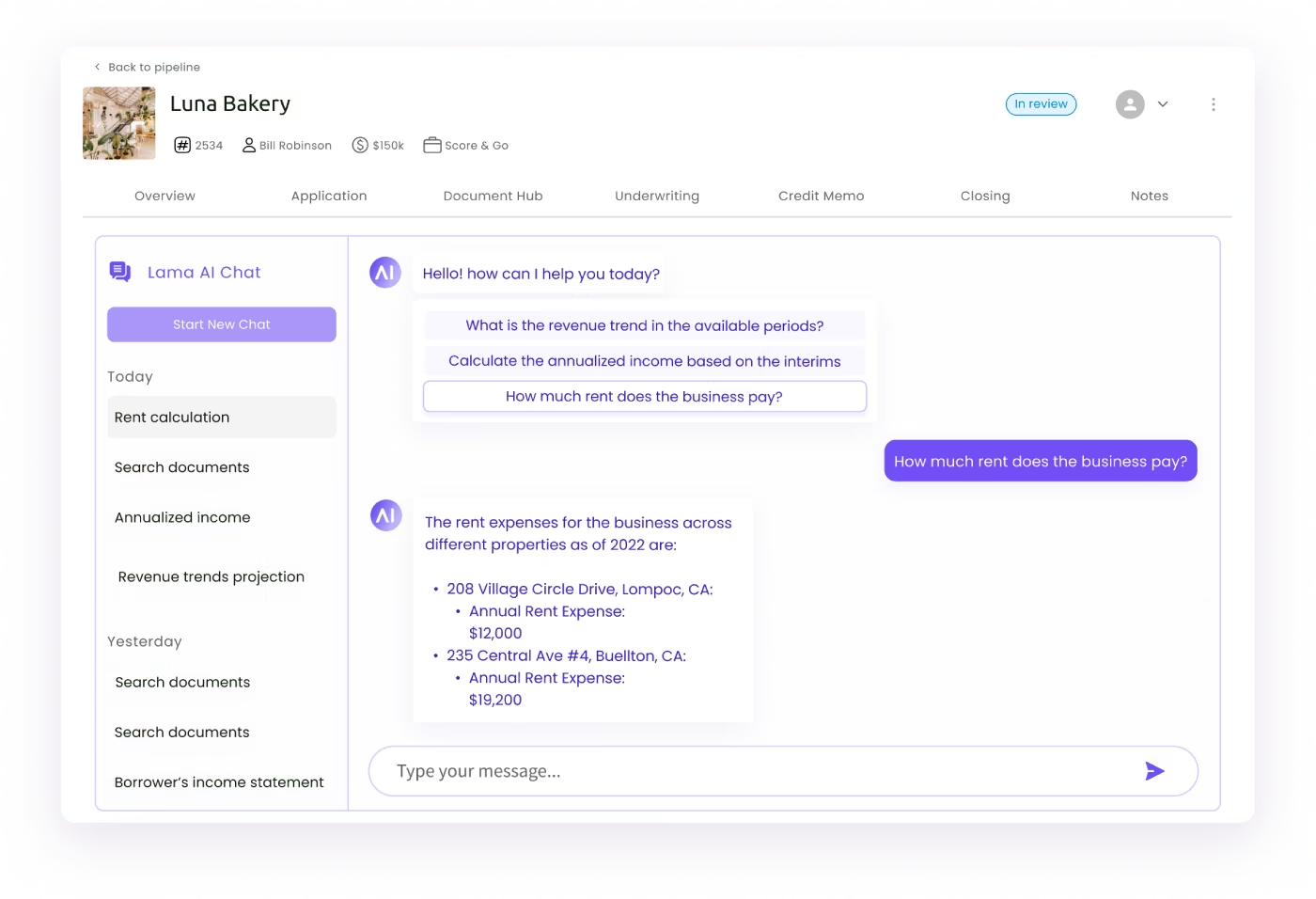

Credit assistant guiding underwriters.

Equip your credit team to decide smarter and faster. A context-aware and explainable AI assistant compiles insights, researches deals, and generates policy-aligned credit narratives in seconds.

Works with the systems you already trust.

With a RESTful API architecture, Lama AI connects seamlessly to your existing stack, including core systems, risk models, verification layers, SoS, E-Tran, and more. Benefit from 100+ pre-built integrations and a frictionless way to add new ones, enhancing operations without disruption or complexity.

All the LOS capabilities, out of the box.

Skip the lengthy implementations and go live fast with plug-and-play functionality ready from day one. When you’re ready to make it fully yours, Lama AI’s configurability enables 100% customization across workflows and processes—in just 3 weeks.

Enterprise-grade security.

Protect your data and your customers’ trust with built-in compliance and bank-level safeguards. Lama AI is SOC 2 Type 2 certified and CCPA/CPRA compliant. With 256-bit AES encryption, role-based access, and SSO support, only the right people have access at every step.

****

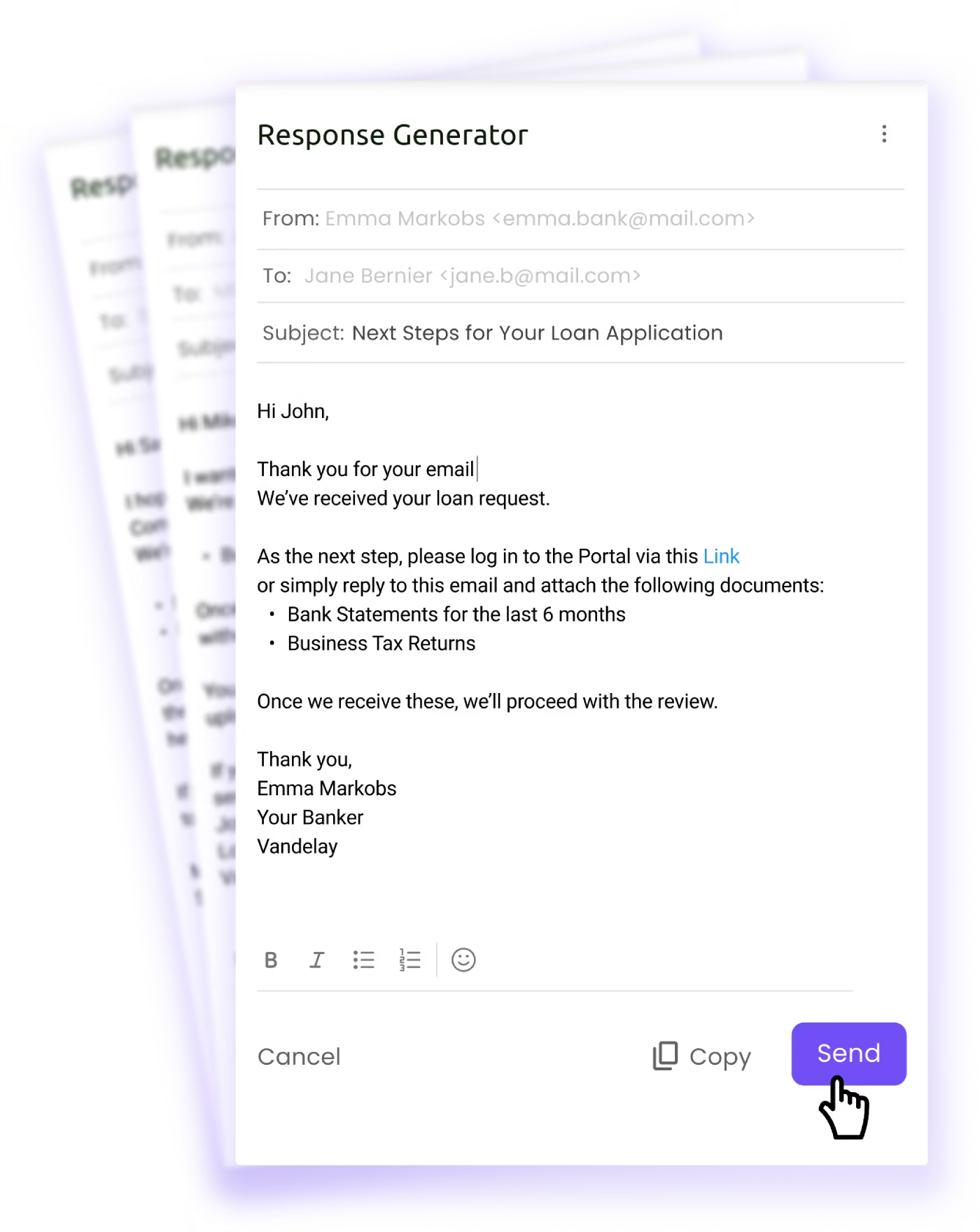

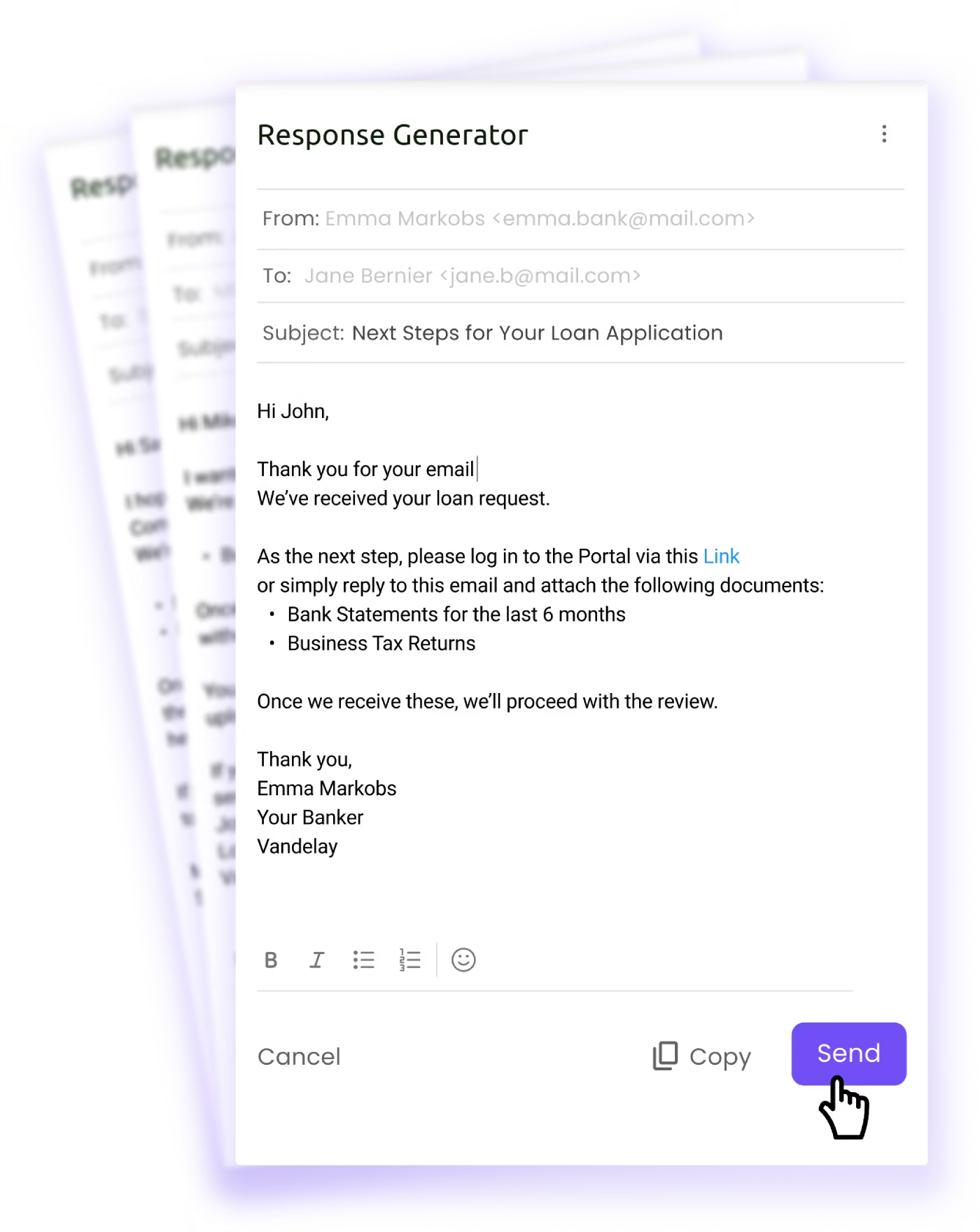

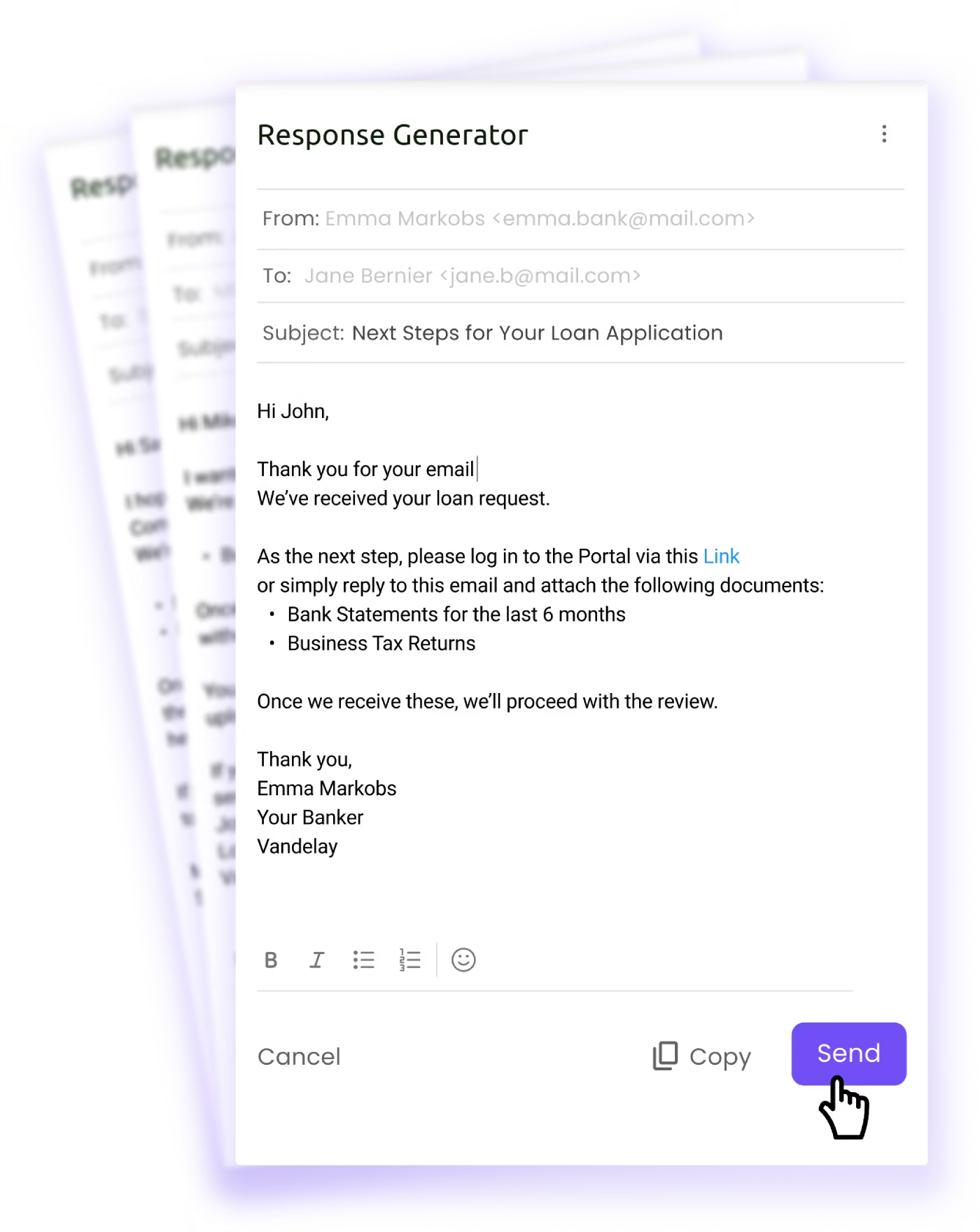

GenAI at your service.

Draft borrower follow-ups, updates, and requests without the hassle. Ready for review and send, your team skips the busywork, reduces time to complete each package, and builds better relationships.

.webp)

.webp)

.webp)

.webp)